Share Market Classes in Aurangabad

- 100% Practical Training

-

Work Directly on Live Charts

- Detailed and Comprehensive Syllabus

- Individual Laptops and PC’s in Classroom

- Premium Infrastructure

- Lifetime Support

Duration – 1 Month

Fees – Rs. 5000 only

Our Principles

Our Vision

Our Mission

INTRODUCTION

Meet Your Trainer

Ajinkya Ghatge

Ajinkya Ghatge is a trainer at FSI’s Share Market Classes. He is a Government College engineer and NISM Certified. He has 3+ years of experience in the field of stock market and investing.

Basic financial terms

Types of Investments and risks involved Introduction to stock market trading Intermediaries involved in markets what is Technical analysis? Advantages, Fundamental VS technical

Introduction to chart patterns-

Trendlines, Support & Resistance Continuation patterns- pennants Flags Wedges Traingles Cup and Handle Reversal patterns Head and Shoulder Double Top Double Bottom Gaps- breakaway, runaway, exhaustion

Technical Analysis Tools and Indicators

Moving Averages Relative strength Index (RSI) Moving Average Convergence Divergence (MACD) Bollinger Bands Fibonacci Retracements

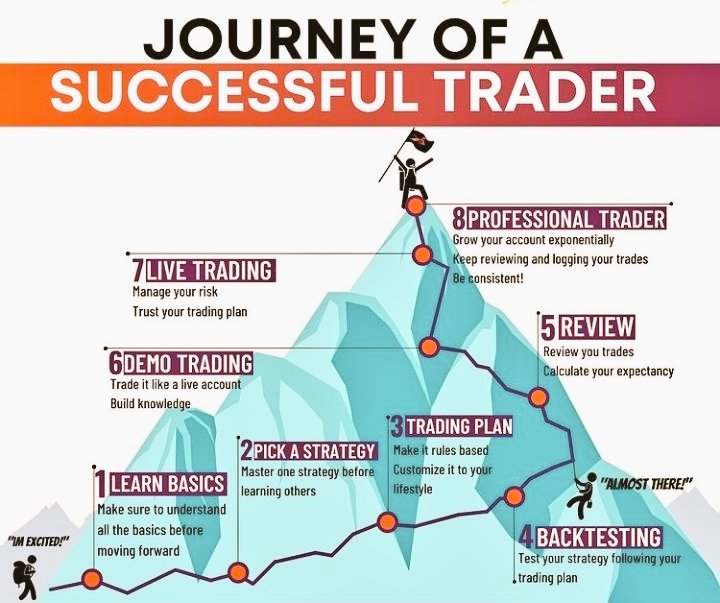

Trading Strategies

Day trading, swing trading, positional trading momentum trading trend following stretegies Contrarian Strategies Trading rules and Entry/ Exit Point

Risk management in Technical analysis

Types of orders position sizing Risk-reward ratio Diversification Psychological aspects in Risk management

Course Content

Introduction to Balance sheet and income statement

Types of Interests

CAGR vs XIRR

Types of Investments and risks involved

Introduction to stock market trading

Intermediaries involved in markets

what is Technical analysis?

Advantages, Fundamental VS technical

Trendlines, Support & Resistance

Continuation patterns-

pennants

Flags

Wedges

Traingles

Cup and Handle

Reversal patterns

Head and Shoulder

Double Top

Double Bottom

Gaps- breakaway, runaway, exhaustion

Moving Averages

Relative strength Index (RSI)

Moving Average Convergence Divergence (MACD)

Bollinger Bands

Fibonacci Retracements

Day trading, swing trading,

positional trading

momentum trading

trend following stretegies

Contrarian Strategies

Trading rules and Entry/ Exit Point

Basics of derivatives

Indian derivatives market

Introduction to Futures & options

Option trading strategies

option selling VS option buying

Types of orders

position sizing

Risk-reward ratio

Diversification

Psychological aspects in Risk

management

Why to Join FSI's - Share Market Course

Learn to analyze and interpret price charts, patterns, and indicators to make informed trading decisions

FSI Made Stock Market Training EASY!

Along with learning how to manage risk and market trends, you also learn how to make money.

With confidence, you can make investment high-yield bets in the market at the correct moment.

100 % Practical on Live charts

Lifetime Support

Experience & Certified Trainer trained

Comprehensive Syllabus

Learn from Scratch to Advance. FSI’s curriculum is designed to provide students with a comprehensive understanding of the stock market, covering topics such as fundamental analysis, technical analysis, risk management, and trading strategies.

Practical Hands-on Training

FSI’s classes are designed to be practical and hands-on, providing students with the opportunity to apply their knowledge and skills in real-world scenarios. Learn 100% live so that you must be ready with Go to Market capabilities.

Experienced and Qualified Faculty

FSI boasts a team of experienced and qualified instructors who possess in-depth knowledge of the stock market and a proven track record of success in teaching students of all levels.

Affordable Fees

FSI's fees are very affordable, making it an accessible option for students of all financial backgrounds. This commitment to affordability ensures that everyone has the opportunity to learn about the stock market and develop the skills they need to succeed.

Educational Blog

Insights & Ideas for Educational Excellence

Unveiling the Essentials: A Guide to Mutual Fund Investing in India Welcome to ‘Unveiling the Essentials: A Guide to Mutual Fund Investing in India.’ In…

Direct Stock Investments: Mastering the Art of Equity Trading Learn the fundamentals of buying…

Equities: The Power of Stocks Dive into the world of stocks and equity investments,…

In the dynamic and often unpredictable landscape of the Indian equity markets, two fundamental…

Frequently Asked Questions

FSI is the Top Most Share Market course in Aurangabad Maharashtra with Best facilities you deserve to learn.

3+ years experienced trainer

100% Practical training and more

Of course! We accommodate students of all skill levels, even those who are beginners. We begin with the fundamentals and work our way up to more complex ideas so that everyone can gain from the instruction.

Indeed, we think that students should receive ongoing help. You will have access to our instructors and resources for any further help you may require after finishing the course.